Goods and services

You can easily add a product or service, that is, what you sell to your customers, such as a language course, a textbook, a translation service, etc.

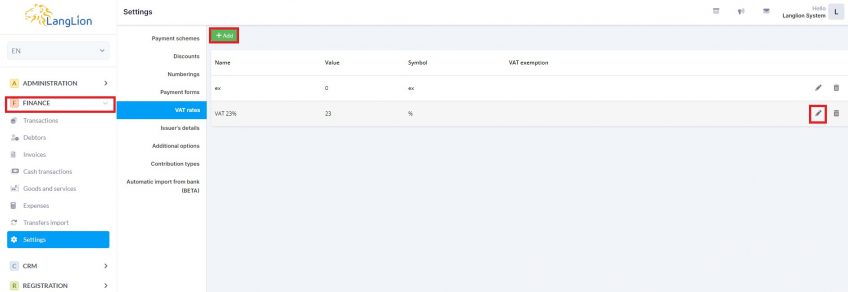

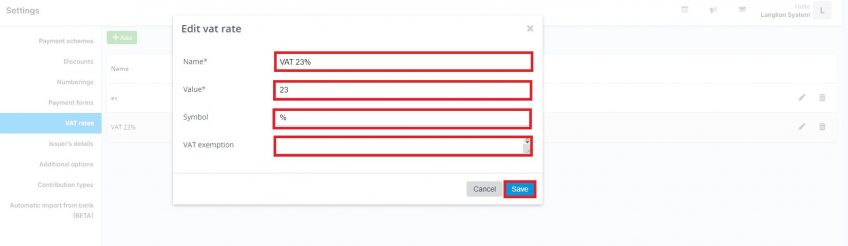

In order to configure the list of goods correctly, first define what VAT rates you use in your company. To create a list of rates, go to the Finance module, select Settings and then VAT rates tab.

Click on the Add button, enter the relevant data and save the changes. Remember that the sign from the Symbol field will be included in invoices and financial documents.

You can assign tax exemption annotations for a given rate.

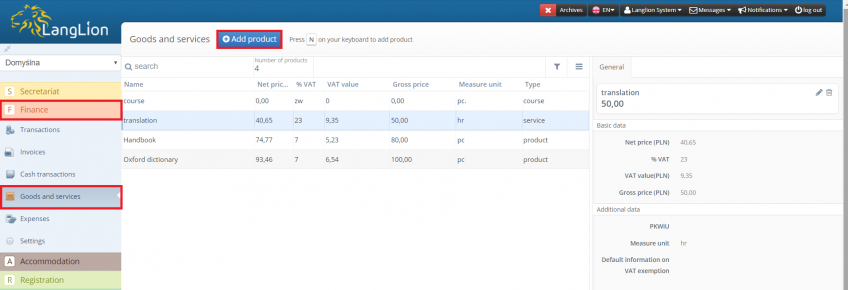

How to add a product?

1. In the Finance module, select Goods and services tab

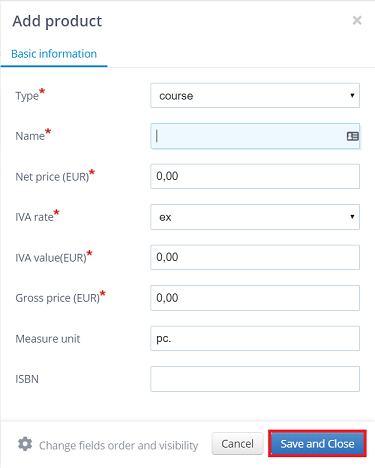

2. Next, click on Add product

3. In the „Add product” window, enter the name, select a tax value from the drop-down list, enter the price, and set the product type.

By adding items to the „Goods and services” tab, you can select the following types: product, service, and course.

When adding a course type of product, do not enter its price. The system will automatically calculate the amount based on the rate in the group.

When billing a student and adding a payment, select a course type item – the system will search for the student’s group and the classes generated in that group, and on the base of that will calculate the amount due.

For items with a fixed unit price (eg book), complete the necessary information. For each buyer, the price for the product or service will be charged according to the data entered here.

4. When finished editing, click „Save and close”.

This way you added a product that you can sell to students.

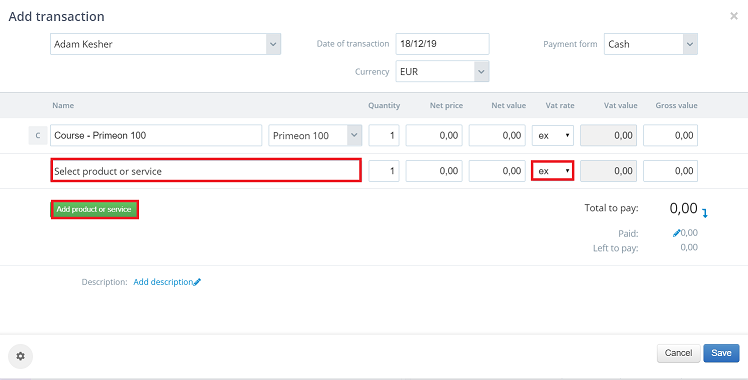

Several products can be added with one payment. Simply select the item you want, then click on the „Add” button and select another item.

If necessary, you can change the VAT rate directly when adding a transaction by selecting the appropriate one from the drop-down list.